Last October 4, 2023, the Philippine Securities and Exchange Commission (SEC) announced that it is planning to revise its Sustainability Reporting (SR) Guidelines for Publicly-Listed Companies (PLCs) or the SEC Memorandum Circular (MC) No. 4, Series of 2019 to promote sustainability reporting in the country. The goal of the revision of the SR Guidelines is to assist PLCs in evaluating and overseeing the non-financial performance of their organizations in Economic, Environmental, and Social dimensions. The revised SR Guidelines are designed to empower PLCs to gauge and supervise their impact on achieving global sustainability goals, such as the United Nations Sustainable Development Goals (UN SDGs), as well as adhering to national policies and programs, like the AmBisyon Natin 20401,2. AmBisyon Nation 2040 is a program of the National Economic and Development Authority (NEDA) of the Philippines, which aims for Filipinos to enjoy a strongly rooted, comfortable, and secure life by 2040 by developing and focusing on the following industries and sectors3:

- Housing and Urban Development

- Manufacturing

- Connectivity

- Education Services

- Tourism and Allied Services

- Agriculture

- Health and Wellness Services

On the same date of the announcement, the SEC released a notice where public comments on the draft MC on the Revised SR Guidelines for PLCs and the SuRe Form were requested. Written comments were collected until October 16, 20231, and results are yet to be released and are currently being addressed and discussed.

Overview of the Draft Revised SR Guidelines

As part of the draft revised SR Guidelines, PLCs are to be required to submit their sustainability report containing the following1,2:

- The Sustainability Report narrative, which will be submitted as an attached Annex of the company’s Annual Report (SEC Form 17-A), which is recommended to contain a one-page Executive Summary or highlights of the company’s sustainability activities, programs, and projects at the beginning of the report, and

- The filled-out Sustainability Report (SuRe) Form in Microsoft Excel format, which will be submitted through the SEC Electronic Filling and Submission Tool (eFAST) online platform.

The SuRe Form will include the following sections and topics1,2:

- Sustainability and Climate-related Opportunities and Risks Exposures (SCORe),

- Cross-Industry Standard Metrics (CISM), and

- Industry-specific metrics (ISM).

The SEC has mentioned that guidelines specifically addressing ISM, which primarily take into account the current Philippine Standard Industrial Classification, will be issued at a future date.

Annual submission of the SuRe Form will be mandated starting 2024. All documents of the reporting year must be submitted the following year (i.e., reports covering year 2023 must be submitted in 2024), and the SuRe Form must be submitted on or before April 15th of the following year of the reporting year. Additionally, for publicly-listed subsidiaries of publicly-listed holding companies, a separate submission must be made (i.e., the publicly-listed holding company must not include publicy-listed subsidiaries in their sustainability reporting and form)1.

Furthermore, it is also stated in the draft SR Guidelines that the mandated sustainability reporting is under a “comply or explain” rule for a period of two years, which means that PLCs are required to report available data and to provide an explanation for data that they currently do not possess. Subsequently, the compulsory submission of all mandated disclosures outlined in the MC will be obligatory and consequently liable to penalties after the two-year period1.

Penalties for Noncompliance of the SR Guidelines

Different levels of penalties will be levied for non-attachment, non-submission, late submission, incomplete submission, and repeat offenders, as shown in the table below1:

| Non-attachment of SR Narrative (more than 30 calendar days from the due date) | Non-submission of SuRe Form (more than 30 calendar days from the due date) | Late submission of either SR Narrative or SuRe Form | Incomplete submission | |

|---|---|---|---|---|

| First Offense | Reprimand/Warning | |||

| Second Offense | PHP 50,000 + PHP 500 per day of delay | PHP 50,000 + PHP 500 per day of delay | PHP 30,000 + PHP 500 per day of delay | PHP 30,000 + PHP 500 per day of delay in completing the SuRe Form |

| Third Offense | PHP 100,000 + PHP 1,000 per day of delay | PHP 100,000 + PHP 1,000 per day of delay | PHP 60,000 + PHP 1,000 per day of delay | PHP 60,000 + PHP 1,000 per day of delay in completing the SuRe Form |

| Fourth Offense | Suspension or Revocation of Secondary license or a fine of PHP 1,000,000 | Suspension or Revocation of Secondary license or a fine of PHP 1,000,000 | PHP 500,000 + PHP 2,000 per day of delay | PHP 500,000 + PHP 2,000 per day of delay in completing the SuRe Form |

International Reporting Standards

The International Sustainability Standards Board (ISSB) issued its first-ever standards on June 26, 2023, comprising IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures). These standards establish a common language for disclosing the impacts of climate-related risks and opportunities to a company, mandating the inclusion of sustainability-related information alongside financial statements in the same reporting1,2.

In line with this, the SEC acknowledges and integrates the latest global developments in sustainability reporting frameworks, encompassing IFRS S1 and IFRS S2, both in full alignment with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. Furthermore, the SEC took into consideration the other significant frameworks, such as the UN SDGs, Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), International Integrated Reporting Council (IIRC), and United Nations Conference on Trade and Development (UNCTAD) – International Standards of Accounting and Reporting (ISAR) Guidance on Core Indicators, among others. The SR Guidelines have been formulated, in part, based on these global advancements in sustainability reporting frameworks1,2.

ISSB and IFRS 1 and 2

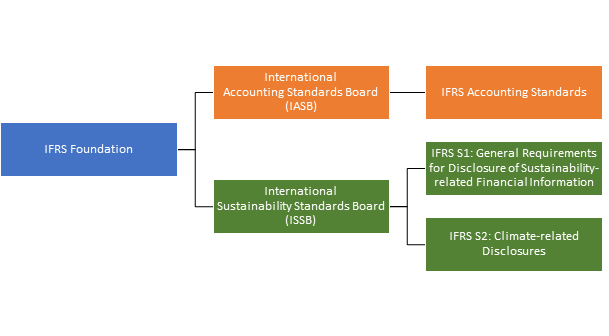

The IFRS (International Financial Reporting Standards) Foundation, a non-profit organization established in 2001, introduced the IFRS Accounting Standards, which was led by its independent standard-setting board, the International Accounting Standards Board (IASB). These standards have evolved into the widely accepted global language for financial statements, earning trust from investors worldwide and being mandated for use in over 140 jurisdictions4.

In response to the growing integration of sustainability information into economic and investment decisions, the IFRS Foundation established the International Sustainability Standards Board (ISSB) in 2021, which was announced during COP26 in Glasgow, as a complementary entity to the IASB. The ISSB is tasked with developing IFRS Sustainability Disclosure Standards, aiming to establish a global foundation for sustainability disclosures that enhances insights for economic and investment decisions4,5.

The ISSB receives broad international support, with endorsements from the G7, G20, International Organization of Securities Commissions (IOSCO), Financial Stability Board, African Finance Ministers, and Finance Ministers and Central Bank Governors from over 40 jurisdictions. The ISSB has outlined four key objectives:

- Developing standards for a global baseline of sustainability disclosures;

- Meeting the information needs of investors;

- Enabling companies to provide comprehensive sustainability information to global capital markets; and

- Facilitating compatibility with disclosures tailored to specific jurisdictions or broader stakeholder groups.

The ISSB released its initial two Standards (IFRS 1 and 2) in June 20234:

| IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information | IFRS S2: Climate-related Disclosures |

|---|---|

| IFRS S1 outlines a set of disclosure requirements to facilitate companies in conveying to investors the sustainability-related financial risks and opportunities they confront across short, medium, and long-term horizons. Key elements:

|

IFRS S2 outlines the criteria for a company to disclose information concerning its climate-related risks and opportunities, while taking into consideration the requirements in IFRS S1.

This standard incorporates the recommendations of TCFD and requires the disclosure of information encompassing both cross-industry and industry-specific climate-related risks and opportunities. Key elements:

|

Figure 1. Summary of the relationship between of IFRS, IASB, ISSB, and IFRS S1 and S2.

Ending remarks

The final version of SEC’s draft revised SR Guidelines has not yet been released as of February 10, 2024, and the contents and information within may still be changed depending on the comments submitted to them by the public and interested parties. The sustainability landscape is dynamic and progressive—new international and national sustainability standards and policies may be created and existing standards may still experience revisions. As the SEC and international organizations continue to refine their guidelines and with the sustainability landscape constantly evolving, it is imperative for stakeholders to remain vigilant, stay well-informed of updates, and actively participate in the discourse. The final version of the revised SR Guidelines may bring about significant changes, and staying informed will empower individuals and organizations to navigate the dynamic and progressive nature of international and national standards and policies.

References

- Securities and Exchange Commission. Request for Comments on the Draft Memorandum Circular on the Revised Sustainability Reporting Guidelines for Publicly Listed Companies and the SEC Sustainability Reporting Form (SuRe Form). Securities and Exchange Commission (2023)

https://www.sec.gov.ph/wp-content/uploads/2023/12/2023Notice_2023RFC_Sure-Guidelines_v2.pdf - Camus, M. R. SEC upgrades sustainability reports. Inquirer.net (2023)

https://business.inquirer.net/425050/sec-upgrades-sustainability-reports - About AmBisyon Natin 2040. National Economic and Development Authority(2016)

https://2040.neda.gov.ph/about-ambisyon-natin-2040/ - IFRS Foundation. ISSB: Frequently Asked Questions. IFRS Foundation (2024)

https://www.ifrs.org/groups/international-sustainability-standards-board/issb-frequently-asked-questions/ - IFRS Foundation. International Sustainability Standards Board. IFRS Foundation (2024)

https://www.ifrs.org/groups/international-sustainability-standards-board/

The Status of Sustainability Reporting in the Philippines

The Status of Sustainability Reporting in the Philippines