China’s carbon market development has evolved through three stages: local pilot exploration, national market foundation-laying, and institutional improvement. At the present stage, it has formed a dual-track framework of “mandatory market + voluntary market.”

In August 2025, the General Office of the Communist Party of China Central Committee and the General Office of the State Council publicly released the “Opinions on Promoting Green and Low-Carbon Transformation and Strengthening National Carbon Market Development” (hereinafter referred to as the “Opinions”). This is the first central-level document in China’s carbon market field, clearly defining the timetable, roadmap, and task list for the medium and long-term development of the national carbon market. The new policy marks a strategic transformation of the carbon market quota system from intensity control to total volume control.

1. Policy Background of China’s Carbon Market Development

In March 2011, the “Outline of the Twelfth Five-Year Plan for National Economic and Social Development” was published, clearly proposing the gradual establishment of a carbon emissions trading market. In October of the same year, the General Office of the National Development and Reform Commission issued the “Notice on Launching Carbon Emissions Trading Pilot Programs,” after which eight provinces and municipalities including Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, Shenzhen, and Fujian launched carbon emissions trading pilots.

In December 2020, the Ministry of Ecology and Environment issued the “Measures for the Administration of Carbon Emissions Trading (Trial),” clarifying details such as offset mechanisms, participation thresholds, quota allocation methods, registration systems, and penalty rules. In July 2021, the national carbon emissions trading market was launched, initially covering only the power generation sector.

In May 2024, the “Interim Regulations on Carbon Emissions Trading” came into effect, establishing the trading system through administrative regulations for the first time and providing legal guarantees for market expansion. In March 2025, the Ministry of Ecology and Environment issued the “Work Plan for Expanding National Carbon Emissions Trading Market Coverage to Steel, Cement, and Aluminum Smelting Industries,” expanding the industry coverage of the national carbon market.

Fig. 1: China’s Carbon Market Legal and Policy System

2. Medium and Long-term Policy Objectives for China’s Carbon Market Development

The policy objectives demonstrate a phased progression approach. The “Opinions on Promoting Green and Low-Carbon Transformation and Strengthening National Carbon Market Development”iproposes the main objectives: “By 2027, the national carbon emissions trading market will basically cover major emitting industries in the industrial sector, and the national voluntary greenhouse gas emission reduction trading market will achieve full coverage of key areas. By 2030, a national carbon emissions trading market based on total quota control, combining free and paid allocation, will be basically established, forming a carbon pricing mechanism with significant emission reduction effects, a sound regulatory system, and reasonable price levels.”

3. Current Status of China’s Carbon Market Development

China’s carbon market adopts a parallel architecture of mandatory and voluntary markets, with clear functional differentiation between the two types: the mandatory market is constrained by policies and regulations, focusing on compliance and fulfillment by key industries; the voluntary market relies on enterprises’ autonomous emission reduction needs, serving carbon neutrality goals and brand value enhancement.

3.1 Current Status of the Mandatory Market

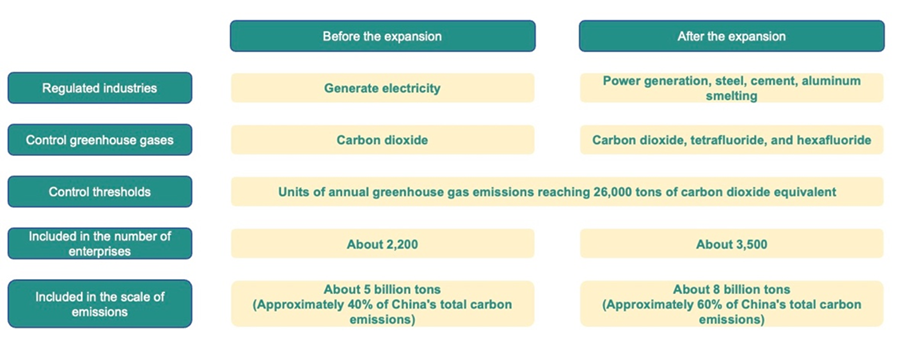

The national carbon emissions trading market currently includes four major industries: power generation, steel, cement, and aluminum smelting. Enterprises must meet the entry threshold of annual emissions of 26,000 tons of CO₂ equivalent, representing a significant expansion from 2021 when it only covered the power generation sector. As of August 22, 2025, the cumulative trading volume of quotas in the mandatory carbon market reached 680 million tons, with a transaction value of 47.41 billion yuan.

Fig. 2: Comparison of National Carbon Emissions Trading Market Before and After the First Expansion of Industry Coverage

Local pilots in Hubei, Guangdong and other regions are exploring differentiated expansion. For example, Hubei has lowered the entry threshold for industrial sectors to 13,000 tons of CO₂ equivalent and plans to cover data centers in 2025 and buildings and freight ports in 2026.

With the expansion of the carbon market and the release of the “Opinions,” ithe overall quota allocation approach aligns with national phased greenhouse gas control objectives. At the current stage, China’s carbon quota allocation adopts a “primarily free, transitioning to paid” model. The present stage is based on intensity control, using a benchmark method that maintains overall industry balance with slight shortfalls. Starting from 2027, the institutional positioning will further emphasize serving the dual control of carbon emissions, implementing an allocation method based on total quota control combining free and paid allocation, with stronger total quota constraints.

3.2 Current Status of the Voluntary Carbon Market

In January 2024, the national voluntary greenhouse gas emission reduction trading market was officially launched. The Ministry of Ecology and Environment, together with relevant departments, issued and implemented the “Measures for the Administration of Voluntary Greenhouse Gas Emission Reduction Trading (Trial),” clarifying the overall approach, work processes, and responsibilities of various market participants in the voluntary emission reduction trading market. Six methodologies for voluntary greenhouse gas emission reduction projects were published, including afforestation carbon sinks, grid-connected solar thermal power generation, grid-connected offshore wind power generation, mangrove cultivation, utilization of low-concentration coal mine methane and ventilation air methane, and energy-saving highway tunnel lighting systems. In August 2025, the Ministry of Ecology and Environment publicly solicited opinions on four methodologies including pure agricultural and forestry biomass grid-connected power generation and cogeneration, offshore oil field associated gas recovery and utilization, onshore gas field testing flare gas recovery and utilization, and onshore oil field low-volume associated gas recovery and utilization, fully mobilizing broader industries and enterprises to participate in carbon reduction actions.

As of the end of August 2025, the national voluntary greenhouse gas emission reduction registration system has cumulatively completed public disclosure of 106 projects, of which 29 projects have completed registration; a cumulative total of 5,975 accounts have been opened. The national voluntary greenhouse gas emission reduction trading market has achieved cumulative trading volume of 2.7061 million tons, with transaction value of 229 million yuan, and average transaction prices repeatedly exceeding 100 yuan/ton.

4. Current Challenges in China’s Carbon Market Development

Unbalanced regional development. China’s carbon market exhibits a significant “strong east, weak west” pattern, with obvious regional differences in infrastructure and trading activity. Eastern coastal regions, leveraging economic advantages and policy pioneering advantages, lead in market innovation capacity: Shanghai Environment and Energy Exchange’s carbon inclusion mechanism has driven annual carbon reduction of millions of tons. In contrast, central and western regions remain dominated by traditional high-energy-consuming industries with weak carbon asset management capabilities. This regional disparity impedes the formation mechanism of unified national market prices, and enterprises face liquidity risks in cross-regional carbon asset allocation, particularly posing compliance challenges for foreign enterprises operating in central and western regions.

Poor international regulatory alignment. China’s carbon market exhibits significant differences from international systems in core rules such as accounting boundaries and offset mechanisms, increasing enterprises’ cross-border compliance costs.

Table 1: Comparison of Differences Between Chinese and European Carbon Markets

| Dimension | China’s National Carbon Market | EU ETS |

|---|---|---|

| Coverage Scope | Power generation, steel, cement, aluminum smelting (4 industries) | Power, manufacturing, aviation, etc. (31 industries) |

| Quota Allocation | Primarily free | Primarily auction-based (57% share) |

| Offset Mechanism | Certified Voluntary Emission Reductions (CCER) can offset up to 5% of compliance obligations | Prohibition on use of international offset instruments |

| Financial Derivatives | Spot trading only | Complete derivatives including futures, options, etc. |

Data quality management faces risks. Although the “Interim Regulations on Carbon Emissions Trading” established a “dual penalty”iv regulatory framework (enterprises falsifying data can be ordered to suspend production for rectification, and technical service agencies engaging in fraud will have their qualifications revoked), data quality management still faces multiple challenges. The application of technologies such as blockchain certification and IoT monitoring is still in the pilot stage, and a unified national data traceability system has not yet been formed. Third-party verification agencies have uneven capabilities, with some agencies having insufficient professional staff leading to questionable credibility of verification conclusions.

Lagging carbon market infrastructure construction constrains market vitality improvement. Regarding trading platforms, although the national carbon market operates through the Shanghai Environment and Energy Exchange, with Beijing Green Exchange responsible for CCER project management, the voluntary market suffers from severe liquidity shortages. China currently only conducts spot trading, and the absence of financial derivatives exacerbates the predicament.

5. Strengthening China’s Carbon Market Development

According to the “Opinions on Promoting Green and Low-Carbon Transformation and Strengthening National Carbon Market Development,” iby 2030, China will strengthen national carbon market development in the following aspects.

Deeply advancing national carbon market development. China will orderly expand the industry coverage of the mandatory carbon market based on industry development status, contribution to carbon and pollution reduction, data quality foundation, and carbon emission characteristics. It will establish a carbon emission quota management system with clear expectations and transparency, clarify medium and long-term carbon emission quota control targets in the market, and gradually transition from intensity control to total volume control. The quota allocation method will shift from free to a combination of free and paid allocation, orderly increasing the proportion of paid allocation. It will strengthen guidance and supervision of carbon emissions trading pilot markets (Beijing, Tianjin, Shanghai, Chongqing, Hubei Province, Guangdong Province, and Shenzhen), establish regular evaluation and exit mechanisms, and no longer establish new local or regional carbon emissions trading markets. Meanwhile, it will actively develop voluntary carbon markets, establish a scientific and comprehensive methodology system, and accelerate methodology development in key areas such as ecosystem carbon sinks, renewable energy, and methane reduction.

Focusing on enhancing carbon market vitality. China will collaborate with financial institutions to explore developing green financial products and services related to carbon emission rights and certified voluntary emission reductions, establishing policy systems for carbon pledging and carbon repurchase. Carbon pledging allows enterprises to use government-allocated carbon quotas or certified voluntary emission reductions as collateral to apply for loans from financial institutions. Carbon repurchase involves quota holders selling carbon assets to third-party institutions with an agreement to repurchase at an agreed price in the future, thus obtaining short-term financing. Additionally, it will prudently advance qualified financial institutions’ participation in national carbon market trading under legal compliance and risk control, timely introduce other non-compliance entities to participate in mandatory carbon market trading, and allow qualified individuals to participate in voluntary carbon market trading.

Improving management level. Strictly regulate carbon emission verification and improve technical verification specifications for key industries. Consolidate the primary responsibility of key emission units for carbon emission accounting and reporting. Strengthen whole-process supervision of carbon emission data quality and severely crack down on all fraudulent behaviors. Furthermore, it will research and improve relevant laws and regulations, continuously strengthen the institutional foundation for carbon market development, and provide strong guarantees for accelerating the construction of a more effective, more dynamic, and more internationally influential national carbon market.

6. Compliance Requirements for Enterprises and Future Trend Analysis of China’s Carbon Market Development

6.1 Compliance Requirements for Enterprises in China’s Carbon Market

Currently, China’s carbon market compliance requirements for enterprises are primarily based on the “Interim Regulations on Carbon Emissions Trading”iv to build a whole-process management system. Key emission units must sequentially complete five critical steps: account opening and registration, data monitoring, report preparation, third-party verification, and quota compliance.

Account opening and registration require enterprises to complete account opening and information filing at designated trading institutions; data monitoring requires establishing internal management systems, conducting monthly certification of key parameters, and submitting reports through the national carbon market management platform; report preparation should submit annual emission reports according to industry guidelines with original records retained for at least 5 years; third-party verification requires certification agencies to verify emission data; finally, quota compliance must be completed within specified deadlines – key emission units must complete quota compliance by December 31 each year, with administrative penalties for insufficient compliance.

6.2 Recommendations for Enterprises to Respond to China’s Carbon Market Changes

In the future, China’s carbon market will present a composite development trend of policy expansion, rising carbon prices, and technological drivers. The Ministry of Ecology and Environment has clearly stated it will steadily expand industry coverage and trading entities, enrich trading varieties, and promote innovation and large-scale application of low-carbon, zero-carbon, and negative-carbon technologies. On one hand, carbon market expansion provides policy guidance and market incentives for enterprises’ low-carbon transformation, prompting enterprises to achieve energy conservation and emission reduction through technological innovation and management optimization, thereby enhancing market competitiveness; on the other hand, enterprises must also address pressures from quota management, data quality control, and increased costs.

Strengthen whole-process data control to ensure compliance and traceability. In terms of data compliance management, enterprises should deploy intelligent monitoring equipment (CEMS) to achieve real-time upload of emission data to the national carbon market management platform, and establish internal data review mechanisms to ensure monthly certification of key parameters is traceable. Establish comprehensive carbon emission data monitoring, reporting, and verification systems to ensure data accuracy and transparency, paying special attention to data quality risks, strengthening internal process control, and avoiding human operational errors or non-compliant reporting.

Dual-track parallel approach to reduce compliance costs, actively participating in market trading and voluntary emission reduction. Regarding quota cost control, enterprises should actively participate in paid quota auctions, locking in compliance costs through medium and long-term contracts; they can also attempt to develop certified voluntary emission reduction (CCER) projects to generate revenue and reduce compliance costs.

Focus on low-carbon technology innovation and application to build long-term competitive advantages. In terms of technology upgrade investment, enterprises should focus on key emission reduction pathways, prioritizing investment in mature technologies such as waste heat utilization and green electricity substitution, while piloting frontier technologies such as carbon capture and storage (CCUS) to obtain policy subsidies. For example, power generation enterprises can achieve quota surplus through technical transformation, both reducing compliance pressure and creating economic benefits. Enterprises should incorporate carbon management into strategic planning, establishing dedicated departments as needed to coordinate quota trading and emission reduction investments.

China Carbon Market Development Policy Dynamics Report

China Carbon Market Development Policy Dynamics Report